retail banking, debt collection, insurance, pensions and more

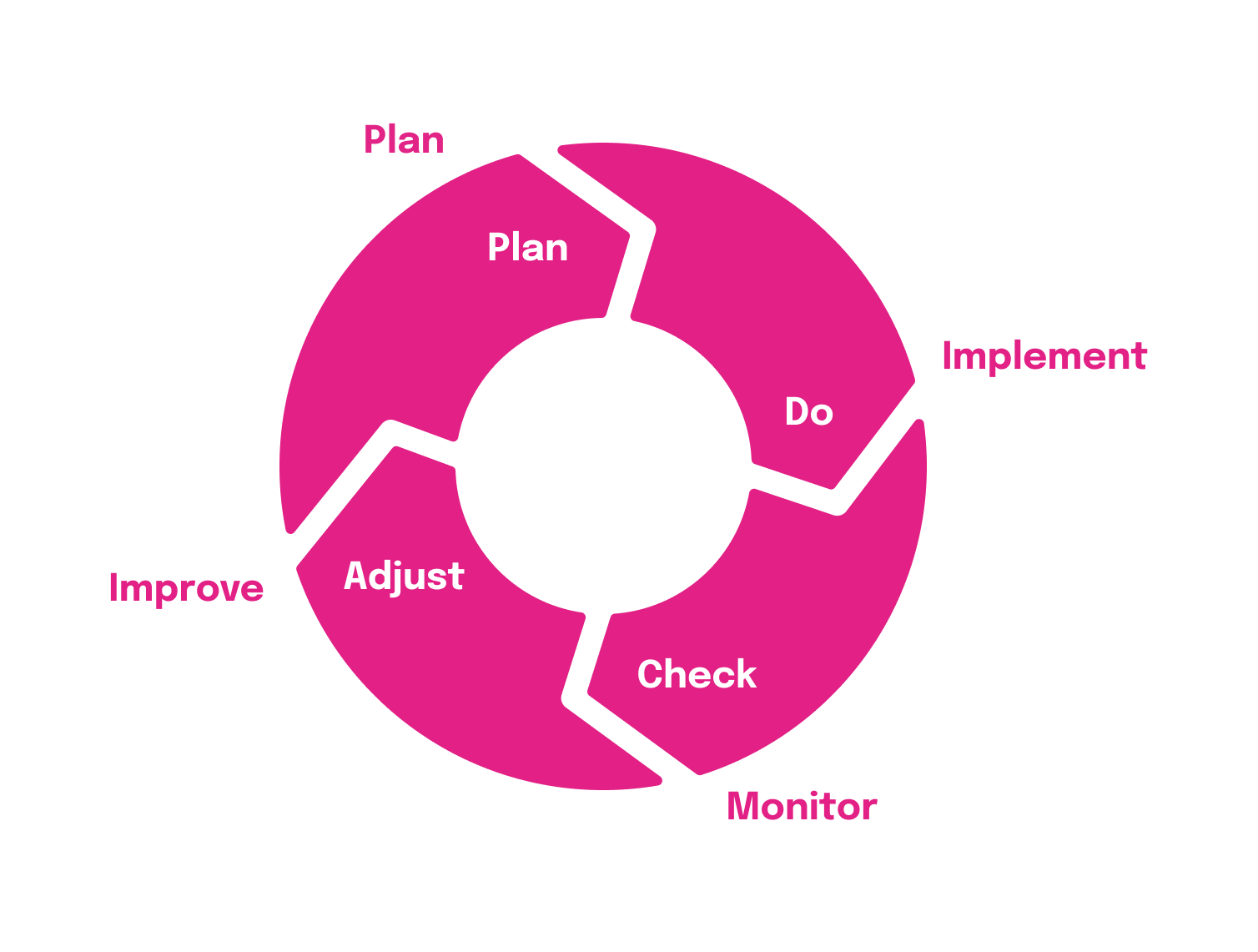

There are three important pillars: organize technology around your customer, evolve your technology landscape and operating model, and know your value, even in a constantly changing world.

The digital transformation in the financial sector will continue, with a focus on the customer, more efficient service provision, and the use of the latest technologies to keep up with continuous change. Connecting the backend, processes, advisors, and/or clients efficiently and connecting infrastructure will provide a competitive advantage.

It will be very interesting to see how new technologies such as AI can further increase companies’ advantages. Having top-notch security is of the essence in all markets, particularly here.

Yonder has developed critical and complex End-to-End banking processes for Garantibank BBVA International on Outsystems. The quality and velocity of the developments are above expectations. The agile working relationship between our scrum team and the Yonder team is very efficient and effective.

COO @Garanti BBVA International

related insights

-

- Bank

Garanti BBVA (Amsterdam) and Yonder – 5 year SAFe and SCRUM partnership

May 31, 2022A partnership for the back office OutSystems solutions of the bank Program Increment (PI) and Stabilization Innovation Planning (SIP) We have [...]

-

- Bank

Yonder congratulates GarantiBank International

May 1, 2018Yonder is very proud that Marco Witteveen, the COO of one of our ingenious clients in the financial sector, GarantiBank International, has won [...]